Translating Corporate Voluntary Agreement (CVA) in Business Practices

Wiki Article

Ultimate Overview to Understanding Company Volunteer Contracts and How They Profit Services

Company Voluntary Agreements (CVAs) have actually become a tactical tool for organizations looking to browse financial obstacles and reorganize their procedures. As the company landscape proceeds to advance, understanding the complexities of CVAs and exactly how they can positively influence business is important for educated decision-making.Understanding Corporate Voluntary Agreements

In the realm of business administration, an essential concept that plays a crucial function fit the relationship between stakeholders and firms is the elaborate mechanism of Business Voluntary Arrangements. These arrangements are voluntary commitments made by business to stick to specific criteria, methods, or goals beyond what is legally required. By participating in Corporate Voluntary Arrangements, firms demonstrate their commitment to social duty, sustainability, and ethical organization practices.One key element of Corporate Volunteer Contracts is that they are not legitimately binding, unlike regulative demands. Business that willingly devote to these contracts are still expected to maintain their pledges, as stopping working to do so can result in reputational damages and loss of stakeholder trust fund. These contracts commonly cover locations such as environmental management, labor civil liberties, diversity and addition, and area interaction.

Benefits of Corporate Volunteer Arrangements

Moving from an exploration of Business Voluntary Agreements' significance, we currently turn our attention to the concrete advantages these contracts supply to business and their stakeholders (corporate voluntary agreement). One of the primary advantages of Corporate Voluntary Contracts is the possibility for business to restructure their financial debts in a more convenient way.Moreover, Business Voluntary Arrangements can boost the company's online reputation and partnerships with stakeholders by showing a commitment to attending to monetary obstacles properly. By proactively seeking remedies through volunteer arrangements, services can display their commitment to meeting commitments and maintaining depend on within the sector. These arrangements can supply a level of discretion, permitting companies to work with financial problems without the public analysis that might accompany other restructuring options. Generally, Company Volunteer Arrangements function as a calculated device for business to browse monetary obstacles while protecting their procedures and relationships.

Refine of Carrying Out CVAs

Understanding the process of applying Business Volunteer Agreements is necessary for companies seeking to browse financial difficulties properly and sustainably. The first step in applying a CVA involves designating a licensed bankruptcy expert who will work closely with the firm to examine its monetary circumstance and viability. Throughout the application process, normal interaction with creditors and persistent monetary monitoring are vital to the effective execution of the CVA and the business's ultimate economic recuperation.Key Considerations for Companies

One more essential consideration is the degree of transparency and communication throughout the CVA procedure. Open up and sincere communication with all stakeholders is vital for constructing trust fund and making sure a smooth application of the agreement. Organizations should also take into consideration seeking professional suggestions from economic specialists or legal specialists to browse the intricacies of the CVA process properly.

Moreover, businesses require to evaluate the long-lasting ramifications of the CVA on their credibility and future financing chances. While a CVA can provide prompt alleviation, it is vital to evaluate a fantastic read just how it may influence relationships with financial institutions and investors in the long run. By meticulously taking into consideration these key aspects, organizations can make educated decisions relating to Company Voluntary Contracts and establish themselves up for a successful economic turnaround.

Success Stories of CVAs in Action

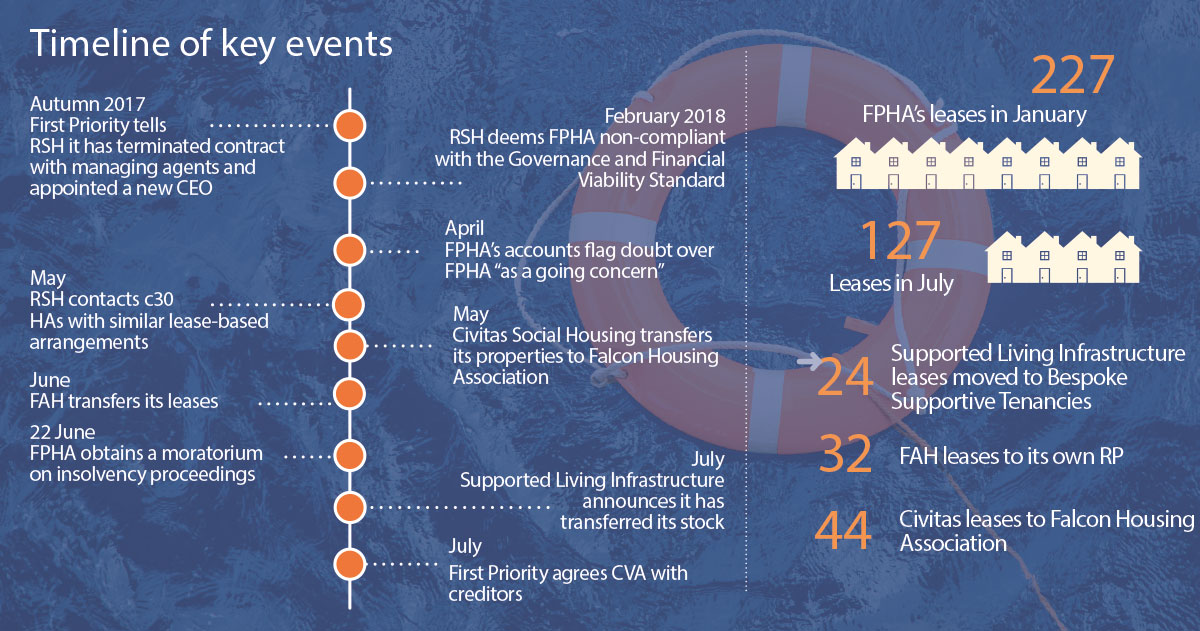

Numerous companies have actually efficiently applied Company Volunteer Agreements, showcasing the efficiency of this economic restructuring tool in rejuvenating their procedures. One noteworthy success tale is that of Company X, a having a hard time retail chain encountering bankruptcy because of mounting financial debts and declining sales. By getting in right into a CVA, Company X had the ability to renegotiate lease agreements with landlords, lower overhead costs, and restructure its financial obligation responsibilities. Consequently, the firm had the ability to support its financial setting, improve cash flow, and prevent bankruptcy.In another circumstances, Business Y, a manufacturing company website firm strained with heritage pension plan liabilities, utilized a CVA to reorganize its pension plan commitments and enhance its operations. Through the CVA procedure, Business Y achieved significant price financial savings, improved its competitiveness, and secured lasting sustainability.

These success stories highlight exactly how Corporate Volunteer Agreements can give having a hard time services with a viable course towards economic recovery and functional turnaround. By proactively attending to economic difficulties and reorganizing commitments, business can arise more powerful, a lot more agile, and better placed for future growth.

Final Thought

In verdict, Company Volunteer Contracts provide services an organized technique to fixing economic troubles and reorganizing financial obligations. By carrying out CVAs, business can prevent insolvency, safeguard their possessions, and maintain relationships with creditors.In the world of company administration, a fundamental principle that plays an essential role in forming the this article connection in between companies and stakeholders is the intricate system of Business Volunteer Contracts. what is a cva agreement?. By entering into Company Volunteer Agreements, business show their commitment to social obligation, sustainability, and moral company techniques

Moving from an expedition of Company Voluntary Contracts' significance, we currently turn our attention to the substantial advantages these agreements use to business and their stakeholders.Moreover, Company Voluntary Arrangements can improve the company's online reputation and connections with stakeholders by demonstrating a dedication to addressing economic challenges sensibly.Comprehending the procedure of implementing Business Voluntary Contracts is vital for companies looking for to browse monetary obstacles efficiently and sustainably.

Report this wiki page